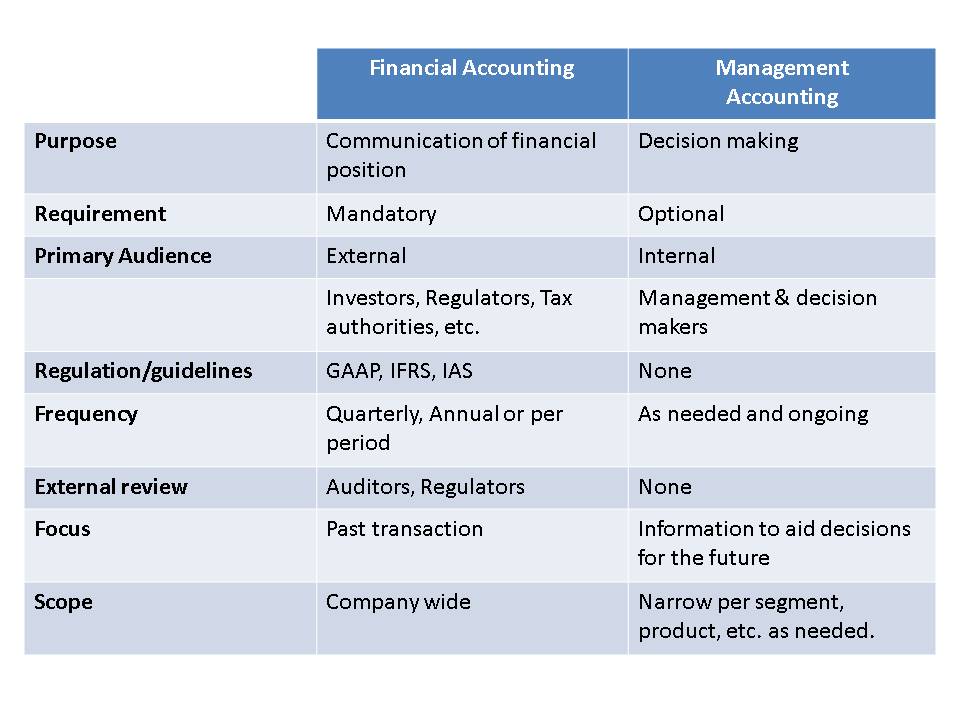

Most companies don’t need every formula, but all small businesses can benefit from at least some management accounting reports. When you’ve met the educational and experiential requirements to get into management accounting, it’s an ideal time to network and continue building relevant skills. Be prepared to start in an entry-level position in a finance department within an organization. Focus on gaining real experience in this role and finding opportunities to hone your skills to advance in management accounting. The major difference between the two accounting types is that management accounting focuses on strategic decision-making within a company, while financial accounting provides analysis for external use.

Discover the simpler way to ESG Compliance

Both financial professions work with financial information in similar ways, but for different purposes and uses. Managerial accountants analyze and relay information related to capital expenditure decisions. This includes the use of standard capital budgeting metrics, such as net present value and internal rate of return, to assist decision-makers on whether to embark on capital-intensive projects or purchases.

- Cloud accounting operates through secure, web-based software designed to streamline business financial processes.

- Financial professionals calculate inventory turnover to determine how long it takes inventory to turn into revenue.

- Managerial decision making includes choosing one option over others, such as whether to make or buy a component part or whether to continue manufacturing a product or not.

- Managerial accounting is useful for companies to track and craft spending budgets, reduce costs, project sales figures, and manage cash flows, among other tasks.

- Scholarship awards include a comprehensive package of benefits enabling students to study for and take the CMA exam at no cost.

Financial Leverage Metrics

Franchise accounting basically deals with tracking specific financial elements—revenues, fees, expenses, and royalties. The text “Managerial Accounting” provides a comprehensive and broad review of the major topics usually covered in an introductory Managerial Accounting course. New terms are explained well in the text when they are first introduced. There is no Table of Contents in the downloadable PDF but a Table of Contents is available at the Open Textbook Library (OTL) webpage where one would download the text. I do use this text in my teaching and I refer students to the OTL Table of Contents. I think this text is a good starting point for OER content for an introductory managerial accounting course.

Learning Managerial Accounting With the CMA Credential

Some of the images are blurry (alot of the tables/forms with the green background), most are readable but a few are not. I didn’t see any spelling errors but sometimes words are scrunched together (no space where there should be some). The text is as successful at being culturally relevant as a Managerial Accounting text could be.

Additionally, if you’re someone who isn’t detail-oriented, having organized financial records and accounting for an LLC can be helpful for budgeting and business projections. While we’ve outlined lots of great skills and examples above, it’s important that you gain or loss avoid listing a whole bunch of irrelevant skills that aren’t on the job description. As technology automates traditional tasks, firms increasingly focus on leveraging accounting advisory services to enhance long-term strategies and client relationships.

Managerial Accounting Methods

Our mission is to equip business owners with the knowledge and confidence to make informed decisions. As part of that, we recommend products and services for their success. The two-part CMA exam will test your knowledge of financial planning, performance, and analytics, as well as strategic financial management. Each institution determines the number of credits recognized by completing this content that may count towards degree requirements, considering any existing credits you may have. Cost-volume-profit (CVP) analysis is the tool that managers can use to better understand the answers to “what-if” questions in order to make better decisions for their companies.

So the management cannot enforce the managerial decisions without referring to a concrete financial accounting system. Managerial accounting, also called management accounting, is a method of accounting that creates statements, reports, and documents that help management in making better decisions related to their business’ performance. While management accounting can help businesses in many ways, it still presents challenges. For starters, the usefulness of management accounting depends on the quality of the information used to create the analyses.

A company’s control over bottlenecks has a direct correlation to profitability, so this is a big one. Understanding the cause and effects of past bottlenecks can help with policy design and strategic planning. Even a lower-level position in management can be a stepping stone to your dream role, from senior accountant all the way up to CFO. These systems vary within the industries they are used within and allow for functionalities and reports specific to that industry. When you enroll in the course, you get access to all of the courses in the Specialization, and you earn a certificate when you complete the work.

I think students might be more likely to work the review problems in this manner as the questions appear more relevant when presented right after the applicable information. The key takeaways are also nice as they seem to reinforce the learning objectives. Overall, I think the book is effective for the purpose of an Introduction to Managerial Accounting. Comprehensive introduction to the key concepts and methodologies of costing, including budgeting, cash flow forecasting, decision analysis, performance evaluation, and non financial measures. The major objective is to provide timely, useful information for use in making business decisions, including plans and forecasts. Other objectives include measuring organizational performance over time so that managers can identify problems that are occurring in one or more business units.

At Finance Strategists, we partner with financial experts to ensure the accuracy of our financial content. Managerial accountants are the closest a company can get to hiring a fortune teller. This way, the team avoids costly mistakes and improves the company’s ability to achieve its objectives. CMAs are also known for their upstanding commitment to professional ethics.

Capital investment analysis is a type of differential analysis that involves evaluating proposed investments in property, plant, and equipment that a company will use in its operations. The goal of a business is to generate profit, which is the difference between income and costs in a particular time period. Costs are the result of paying cash or committing to pay cash in the future in order to earn revenue. Costs may be accumulated for a product, sales territory, department, or activity. It is critical to analyze costs because controlling them directly impacts profitability.